You may have heard of names like Kodak, Blockbuster, or MySpace. These three companies were the pioneers of their respective fields but they since disappeared. Why? Because these companies were slow or short-sighted to see the strategic risk iceberg that destroyed their business.

Every company in the organizational paradigm takes risks. They have to do it otherwise they would never realize the direction that the market is taking and how they need to improvise to keep their ship floating in this vast ever-changing ocean.

All of the brands and different electronic devices that you see in your hands daily nowadays were strategic risks at one time and now we don’t even consider them a wonder anymore because they are so mainstream.

This innovation and changing the world by a simple device like the iPhone that changed the whole world when it came out, is the reason why organizations need to take strategic risks and change the game as long as they can so that the world becomes a more interesting place.

Taking risks is tough, but how can you make sure that the risk that you are taking doesn’t damage the company or its reputation in any way? Well, you do that by managing these strategic risks that you are about to take.

In this article, we will let you know all about strategic risks, how they are comparable to other types of risks and how you can successfully manage these types of risks to bring value and success to the company.

What are Strategic Risks?

Source: LaConte Consulting

In business, there are a lot of risks that the company has to take and endure if the risk doesn’t pan out. But there are risks that if you don’t take like certain decisions to change the business direction or something of that sort, can eviscerate the business. These are strategic risks.

At its core, strategic risks are the ones that affect the company’s whole strategy to function and conduct its business. They are very difficult to spot and manage like the other risks that threaten organizations nowadays. Why? Because this risk is not always “negative”.

What do we mean by that? Well, all the other types of risks pose an imminent threat that needs to be resolved for the business to prosper but not strategic risks. Don’t get it wrong because strategic risks also pose a threat but they can also be a blessing in disguise.

This means that managers and the other high-level stakeholders need to look for these strategic risks by labeling them as things to be mitigated or hedged.

Another thing to remember is that all of the other types of risks arse from factors outside the domain of the company, but strategic risks are the ones that can be applied to the current products produced by the company and how these products are going to be released in the market.

How can You Identify Strategic Risks?

When you are ready to identify and manage strategic risks, two essential tools should always be in your toolkit. They are:

- A thorough understanding of your company, your potential customer, your market sector, all of your competitors in the market, and the business environment that your company resides in

- Also, you need to make sure that you are well-versed in all of your company’s strategic goals from their very conception to their expected execution

Gathering information on both of these can be very challenging from a time and investment perspective but you must gain as much data as you can relating to strategic risks. Why? Because the more data you have the more you can safeguard your company’s success.

It’s a good practice to keep a long list of these risks at hand. That will enable you to eliminate the ones that are not that impactful, and also, this list will help you have a look at all of the risks and not underestimate any of them.

Looking for top risk management software? This one is for you:

The Best Risk Management Software of 2024

Different Approaches to Identify, Measure and Manage Strategic Risks

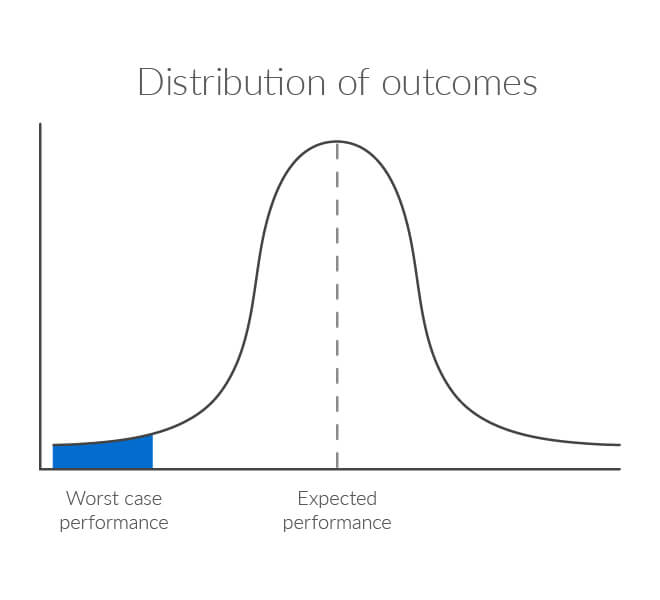

So, now you know what strategic risks are and how they are related to your organization, but what is the severity of the impact that they will have on your company, and is it worth your time to even manage the risk?

The following are some of the metrics that can help you measure and manage strategic risks. They are:

- Firstly, we have economic capital. This metric allows different companies in the organizational paradigm to quantify various types of risks whether these risks relate to launching new products in the market, acquiring more business or enterprises, or expanding into different domains.

- The second metric is the RAROC. Companies use this metric to make sure that the strategy that is going to use is going to produce value or not. It also helps to guide the leaders of the company in their decision-making process.

Companies all over the world can use these two metrics, but the results and the stakes depending on them would be quite different for big and small businesses.

Additional Reading:

6 Steps in the Risk Management Process

Strategic Risk Management Framework Template

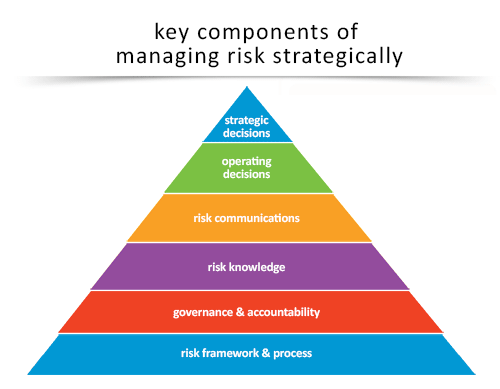

Now that you have all the information regarding Strategic risks, you need to compile it in one location and that location is known as a Strategic Risk Management Framework.

This is where you gather all of the resources that are required to reduce the losses that are caused by external or internal damages.

Let’s take a look at how a strategic risk management framework is made.

- The first step is to understand your current position in the process of managing strategic risks. You can use a SWOT analysis to get this task done

- The second step is to define the strategy that you are going to use in the management process and what are the goals that are to achieve through this strategy

- The next step is to select all of the key performance indicators that can be used to measure changes, and successes and explore different improvement opportunities over time

- Following that, you need to identify all of those risks that can hinder productivity and performance

- All of the KRIs are to be identified as well

- The last step is to continuously monitor KRIs, KPIs, and all of the internal processes that are needed to achieve success.

FAQs

1. What are some examples of strategic risks?

Here are a few examples of strategic risks:

- Sudden changes in senior management

- Financial difficulties

- A shift in market trends

- Introduction of new products and technologies

- Changes in customers’ demands, etc.

2. What are the key principles of a risk strategy?

A risk strategy is developed on the basis of the following key principles:

- Identification of the risk

- Risk analysis

- Risk Control

- Include stakeholders and team members

- Review and revise risk strategy

- Continuous improvement

3. Who is responsible for managing strategic risks?

Although risks are managed by project managers, strategic risks are a liability of top management. According to a survey conducted by Deloitte, 67% of the surveyed companies are of the view that the CEO, board, or board risk committee has the responsibility to manage strategic risks.

Conclusion

All in all, strategic risk management requires perseverance and leadership skills. However, it only works if you have the capacity to improvise as per the project’s ever-changing curve in real-life situations. We would like to hear your thoughts from the perspective of a professional project manager. Feel free to enlighten your fellow readers at nTask Manager Blog by using the comments section below.