In this era of digital transformation, companies are increasingly turning to technology and data-driven solutions to streamline their processes. One such solution is risk intelligence, which involves using data and analytics more effectively to manage risk. But what exactly is risk intelligence? And how can it benefit your organization?

This blog post will answer those questions and explain the principles behind risk intelligence, as well as how you can use it to identify risks in your organization and create strategies to mitigate them.

What is risk management?

Risk intelligence (RI) is the ability to identify, assess, and respond to risks. It involves the gathering and analysis of information about potential threats and vulnerabilities. RI can help organizations protect themselves from harm and make better decisions about how to allocate resources.

Some common methods for gathering risk intelligence include:

- Identifying relevant sources of information: This can include news reports, government data, industry reports, etc.

- Monitoring social media: Social media can be a wealth of information about potential risks. Organizations should consider monitoring platforms such as Twitter, Facebook, YouTube, and view Instagram stories anonymously for risk-related content.

- Conducting interviews and surveys: Interviews with experts and surveys of employees or customers can provide valuable insights into potential risks.

- Analyzing data: Data collected from various sources should be analyzed to identify trends and patterns that could indicate a potential risk.

Importance and Benefits of risk intelligence

Risk intelligence is a relatively new concept in the world of business, but it is one that is quickly gaining traction. Risk intelligence is the ability to collect and analyze data to identify risks and opportunities. It can be used in a variety of different ways, but its ultimate goal is to help businesses make better decisions about how to manage risk.

There are a number of reasons why risk intelligence is so important. First, it can help businesses identify potential risks before they materialize. This allows businesses to take steps to avoid or mitigate these risks before they cause any damage. Second, risk intelligence can help businesses identify new opportunities. By understanding where risks are located and how they might impact different parts of the business, companies can develop strategies to take advantage of these opportunities.

Third, risk intelligence can help businesses improve their decision-making processes. By understanding how different risks might impact different decisions, companies can learn to make better choices about which risks to take and which to avoid. fourth, risk intelligence can help businesses build more effective teams. By understanding which team members are best at identifying and managing different types of risk, companies can create teams that are more effective at dealing with risk overall.

Ultimately, risk intelligence provides a number of benefits for businesses. It helps them identify potential risks before they materialize, understand where new opportunities might be located, improve their decision-making processes, and build more effective teams. Risk intelligence is an important tool for any business that wants to stay ahead

Types of risk management

There are four main types of risk management: financial, physical, informational, and reputational.

- Financial risks include things like market and interest rate fluctuations, changes in the value of assets, and credit risks.

- Physical risks include fires, floods, and other natural disasters.

- Informational risks include data breaches, cyber-attacks, and loss of proprietary information.

- Reputational risks include public relations disasters and negative publicity.

Each type of risk management has its own set of tools and techniques that can be used to mitigate or transfer the risk. For financial risks, hedging and insurance are common mitigation strategies. For physical risks, diversification and site selection are common mitigation strategies.

For informational risks, encryption and access control are common mitigation strategies. And for reputational risks, damage control, and crisis communications are common mitigation strategies.

Methods to identify risk

There are a number of methods that can be used to identify risk. One common approach is to use a risk management tool, such as a Risk Register. This allows you to identify and track risks in a systematic way.

Another approach is to carry out a risk assessment. This involves looking at all the potential risks that could affect your organization and then assessing their likelihood and impact. This can help you prioritize which risks need to be managed more carefully.

It’s also important to keep up to date with changes in your industry and sector, as this can create new risks that you need to be aware of. Keeping abreast of developments in your field can help you identify emerging risks early on.

Finally, it’s also helpful to talk to other businesses in your sector about the risks they are facing. Sharing information about risks can help you build up a better picture of the landscape and identify areas where you may be particularly vulnerable.

What are the 5 measures of risk?

There is no single definition of risk, but in general, risk can be defined as the probability of an event occurring that will have a negative impact on your organization. There are many different measures of risk, but some of the most common include:

- Probability: This is the likelihood that an event will occur. Probability can be expressed as a number between 0 and 1, or as a percentage.

- Impact: This is the potential severity of the consequences if an event does occur. The impact can be measured in terms of financial loss, injury, or death.

- Anticipation: This is the degree to which you are prepared for an event if it does occur. Anticipation can be measured in terms of having a plan in place, having adequate insurance coverage, or having trained staff who know how to respond to an incident.

- Mitigation: This is the degree to which you can reduce the probability or impact of an event occurring. Mitigation can be achieved through measures such as security cameras, burglar alarms, or sprinkler systems.

- Acceptance: This is the degree to which you are willing to live with the risk of an event occurring. Acceptance can be measured in terms of how much financial loss you are willing to tolerate, or how much safety you are willing to sacrifice.

What are the 7 ways of risk identification?

There are seven ways of risk identification:

- Interviews: This involves talking to people who are knowledgeable about the organization and its operations. This can include employees, managers, customers, suppliers, and other stakeholders.

- Brainstorming: This is a technique where a group of people get together and discuss potential risks. This can be done with employees, managers, customers, suppliers, and other stakeholders.

- Observation: This involves observing the organization and its operations. This can be done by employees, managers, customers, suppliers, and other stakeholders.

- Document analysis: This involves reviewing documents related to the organization and its operations. This can include financial statements, marketing materials, customer surveys, employee files, etc.

- Delphi technique: This is a structured method of soliciting input from a group of experts on a topic. The experts anonymously provide their opinions which are then compiled and used to generate consensus estimates.

- SWOT analysis: This is an analytical tool used to identify the strengths, weaknesses, opportunities, and threats facing an organization.

- Risk register: A risk register is a document that lists all the risks facing an organization as well as information on each risk such as its probability of occurring and potential impact

What is the purpose of a threat intelligence platform?

A threat intelligence platform is a system that is designed to collect, analyze, and share information about cyber threats. It can be used by organizations to help them identify, understand, and respond to threats. A threat intelligence platform can also help organizations share information about threats so that they can better protect themselves and their customers.

Examples of threat intelligence platform

In order to best understand how a threat intelligence platform (TIP) can benefit your organization, it’s important to first understand what TIPs are and what they do. A TIP is a software application that helps analysts collect, analyze, and report on data related to security threats.

This data can come from a variety of sources, including public websites, private databases, and underground forums. Tips use a variety of techniques to make this data more useful, such as natural language processing and machine learning.

There are many different types of TIPs available, but they all have one goal: to help organizations better understand the threats they face so that they can take steps to mitigate them. Some TIPs are designed for specific industries or organizations, while others are more general in nature.

No matter what type of TIP you choose, it should be able to provide you with actionable intelligence that you can use to improve your security posture.

Some popular examples of threat intelligence platforms include:

- Anubis Networks: Anubis Networks is a Brazil-based company that offers a cloud-based TIP called AnubisNet Intelligence (ANI). ANI includes features such as malware analysis, DNS monitoring, and phishing detection.

- Recorded Future: Recorded Future is a US-based company that offers both on-premises and cloud-based versions of its TIP. Its features include real-time threat intelligence, historical data

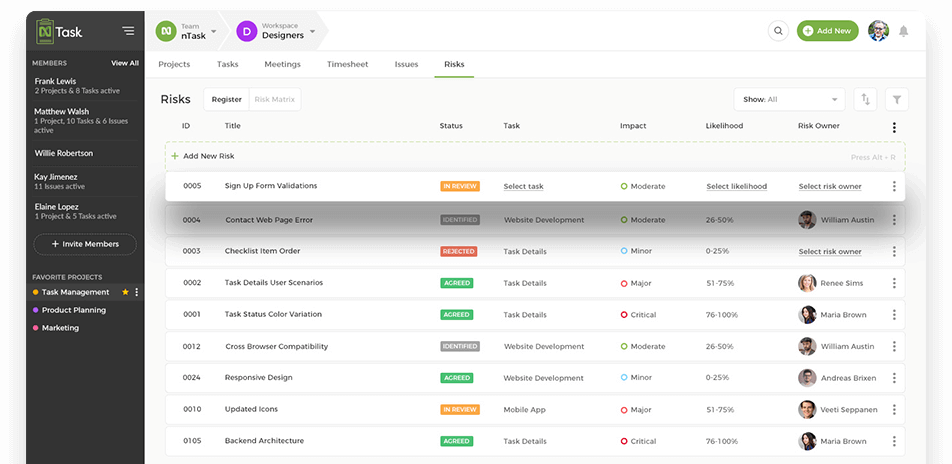

Why is nTask the best software for your risk intelligence requirements?

nTask is the best software for your risk management requirements because it is specifically designed to help organizations collect and analyze data to identify risks. nTask allows you to easily create and track tasks, projects, and goals while also providing powerful tools for analyzing your data. With nTask, you can quickly identify risks and take action to mitigate them.

nTask also provides built-in features that help you manage risk and compliance. This includes personalized alerts and reports, real-time dashboards, document collaboration tools, and a comprehensive risk library. The software is also cost-effective and can be customized to meet the needs of any size organization.

Tips on using risk intelligence for your organization’s benefit

Risk intelligence is the ability to identify, assess and respond to risks. It is a critical part of any organization’s risk management strategy.

There are many benefits to using risk intelligence in your organization. It can help you make better decisions, avoid surprises and potential disasters, and protect your reputation.

Here are some tips on how you can use risk intelligence to benefit your organization:

1. Identify risks early

Risk intelligence can help you identify risks early on before they become major problems. This allows you to take proactive measures to avoid or mitigate them.

2. Assess risks accurately

To make the best decisions, you need accurate information about the risks involved. Risk intelligence can help you gather accurate data and information about potential risks. This allows you to assess them more effectively and make better decisions about how to respond.

3. Respond quickly and appropriately to risks

Once you have identified and assessed risk, you need to respond quickly and appropriately. Risk intelligence can help you develop an effective response plan and execute it quickly and efficiently.

FAQs

What does a risk intelligence analyst do?

What are the 3 stages of risk identification?

Risk intelligence is the process of identifying, analyzing, and understanding these risks so that they can be managed effectively

There are three stages of risk identification:

1. Identifying the risks that could potentially have a negative impact on the organization. This stage involves looking at all aspects of the organization’s operations and identifying any areas where risk could occur.

2. Analyzing the likelihood of each risk occurring and its potential impact on the organization. This stage allows organizations to prioritize their risks and focus on those that are most likely to occur or have the greatest potential impact.

3. Understanding the root causes of each risk and how it can be mitigated or managed effectively. This stage helps organizations develop strategies to reduce the likelihood of a risk occurring or minimize its impact if it does occur.

What are the 6 principles of risk management?

1. Identification: Finding and recognizing risks is the first step to managing them. To identify risks, you need to understand your organization’s activities, objectives, and operating environment. You also need to consult with stakeholders and look at past events.

2. Assessment: Once you’ve identified risks, you need to assess their likelihood and potential impact on your organization. This will help you prioritize which risks need to be managed.

3. Control: You need to put controls in place to manage the risks that have been identified and assessed as being high priorities. Controls can be preventive or corrective, and they should be cost-effective and appropriate for the risk.

4. Financing: You need to budget for risk management activities such as identifying risks, assessing them, and putting controls in place. Risk financing can come from internal sources or external sources such as insurance policies.

5. Measurement: You need to measure the effectiveness of your risk management activities on an ongoing basis. This will help you fine-tune your approach and make sure that it is effective in mitigating risks.

6. Reporting: You need to report on your risk management activities regularly to senior management and the board of directors. This reporting should include information on identified risks, assessment results, control measures implemented, and their effectiveness, as well as any changes made to the risk management program.

Conclusion

Risk intelligence is a vital tool for any modern organization and helps them to identify and mitigate risks that may affect the success of their business. By understanding how risk works in different environments, organizations can better prepare themselves to respond quickly when things go wrong and ensure they take appropriate action to minimize disruption.

With an increased focus on proactive risk management, businesses are more likely to remain competitive in today’s rapidly changing global market.

More Resources For You: